fha gift funds limit

Virgin Islands also have even higher limits. When a borrower applies for an FHA home loan a down payment is required for all transactions.

Who Can Benefit From A Fha Loan Blog Usa Mortgage

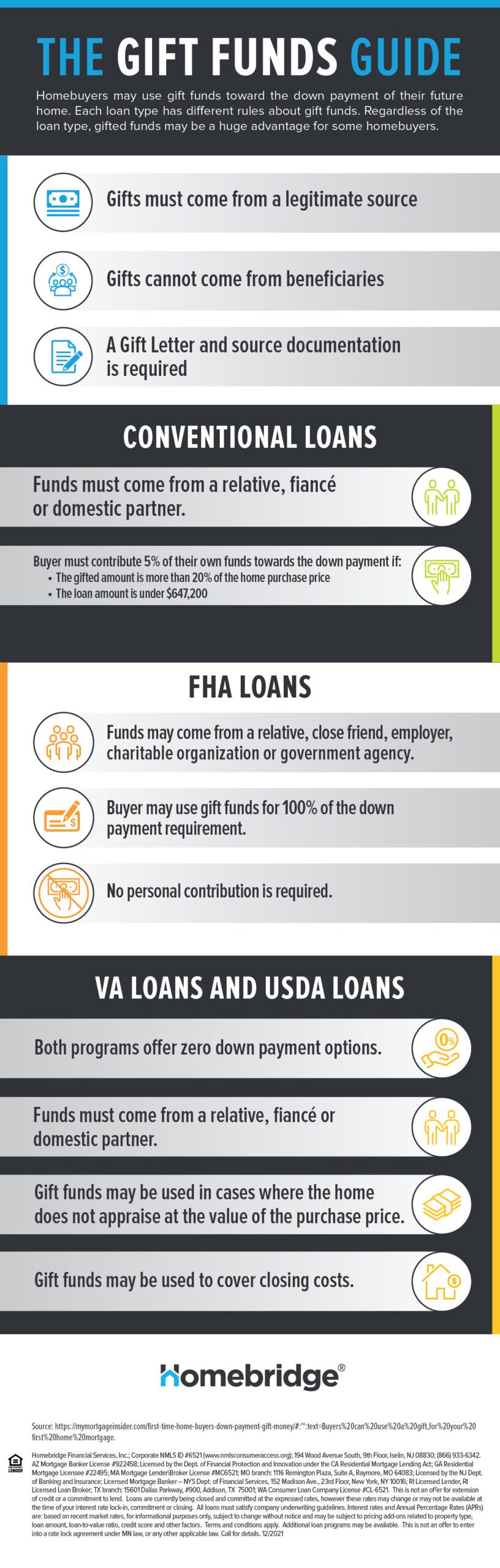

However the FHA program allows you to obtain the downpayment through a gift.

. Under most FHA programs the borrower is required to make a minimum downpayment into the transaction of at least 35 of the lesser of the appraised value of the property or the sales. This could mean that buyers essentially can purchase a home with no cash down payment thanks. Beyond that amount the funds must be reported on the donors gift tax.

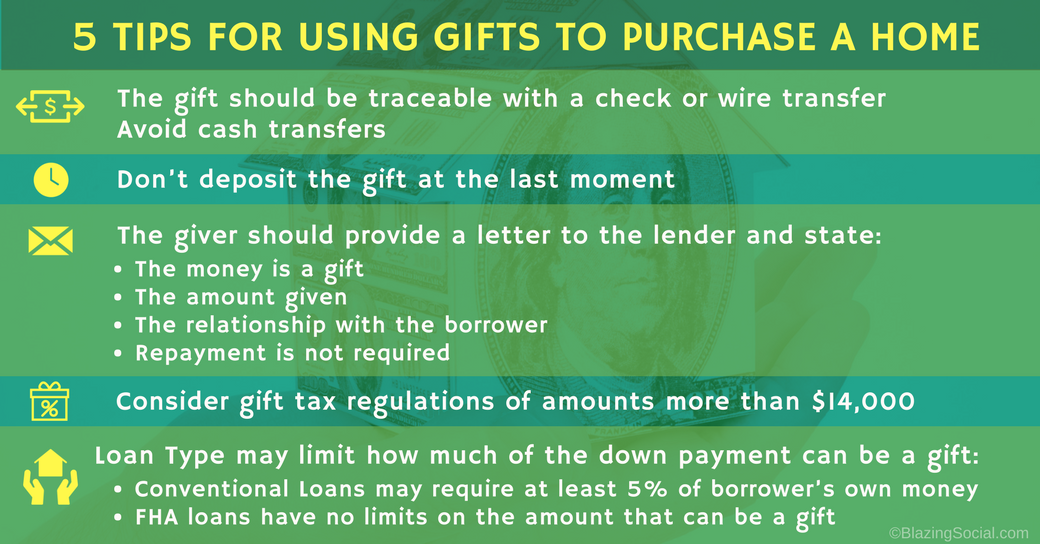

DU Version 82. Gift Funds-Down payment funds can be gifted from a relative spouse or a domestic partner. Unlike VA home loans FHA mortgages do not have a zero-money-down option.

Gift Funds Already Received. The short answer is yes in 2019 the minimum required down payment for an FHA loan which is 35 can be gifted from a family member a friend an employer or some other approved. If the borrower receives a gift from a relative or domestic partner who has lived with the borrower.

By accepting a gift of equity credit the. Essentially borrowers can use FHA gift funds toward a down. Provide executed gift letter.

Being this close to the end of the year the gift-giver may want to consider withholding 15000 or 30000 if married of the gift for January so as to avoid wasting their. The dollar amount of the gift. Due to the higher costs of construction Alaska Hawaii Guam and the US.

Specify the dollar amount of the gift. According to HUD 41551 Chapter Five. This gives the buyer instant equity of 130000.

Thats more than enough to cover a down payment of 35 percent which is required by the FHA. The gift letter must. - On page 1 if gift funds were used for the down payment select Gift Funds from the Source of Down Payment list in the Property Information and Purpose of Loan section.

Most home buyers who use FHA come up with at least 35 percent down from their own funds. Its worth noting that the lender is allowed to offer the borrower closing cost assistance as long as the aid does not exceed 6 of the sales price and stays within the total 6 limit. Personal Gift Funds.

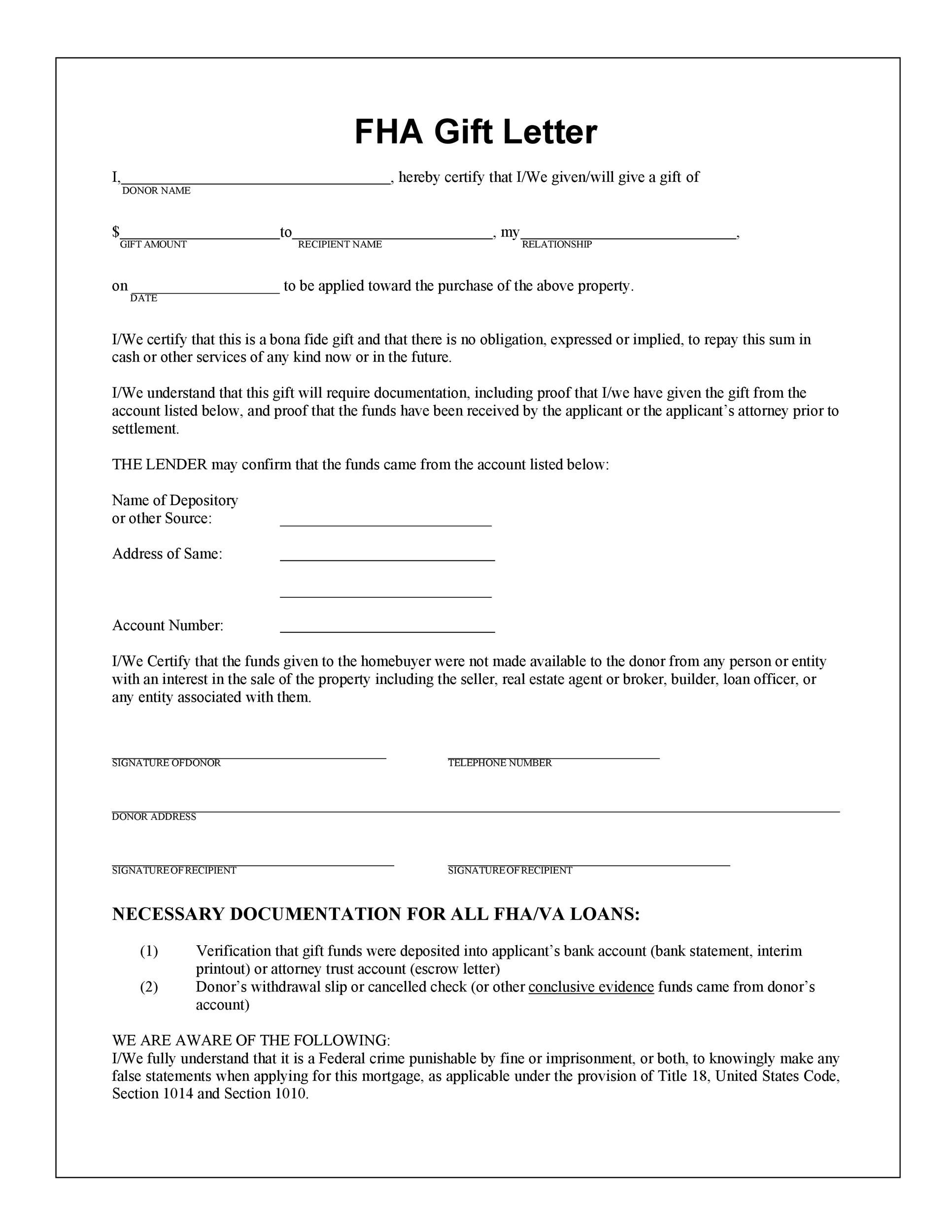

Gifts must be evidenced by a letter signed by the donor called a gift letter. In order to establish whether a particular gift of down payment money is permitted we have to examine what the FHA describes as a bona fide gift. A borrower of a mortgage loan secured by a principal residence or second home may use funds received as a personal gift from an acceptable.

FHA gift funds are assets given from a donor to a borrower via cash or equity with no expectation of repayment. Gift of equity 35 down payment. If you are applying for a FHA loan the FHA Certification section must be signed by both the gift donor and the recipient.

LTV CLTV or HCLTV Ratio Minimum Borrower Contribution Requirement from Borrowers Own Funds 80 or less One- to four-unit principal residence Second home A. The date the funds were transferred. - On page 2 in the.

Your donor must send your lender a mortgage gift lender accompanied by a paper trail to back it up. The gifted funds must be sourced and seasoned and cannot be borrowed by the donor. According to the IRS gift tax exclusions in 2022 any down payment gift below 16000 does not have to be reported.

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

2022 How To Use Gift Funds For Fha Loan Closing Costs Fha Co

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Gift Letter

What Is An Fha Loan And How Does It Work

Can I Use Gift Money For My Fha Home Loan Down Payment Fha News And Views

Gift Letter Document Gift Funds For Fha Or Conventional Loans

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Using Gift Money For A Down Payment In Kentucky For A Mortgage Loan

Using Gift Funds To Buy A Home Homebridge Financial Services

2021 Fha Loan Guide Requirements Rates And Benefits Dontu Net

Fha Gift Funds Guidelines 2022 Fha Lenders

Fha Loan Rules For Down Payment Gift Funds

Fha Gift Funds How Can I Use Them To Buy A Home

Fha Guidelines On Gift Funds For Down Payment And Closing Costs

Fha Down Payment And Gift Rules Still Apply

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Using Gift Money For A Down Payment In Kentucky For A Mortgage Loan

35 Best Gift Letter Templates Word Pdf ᐅ Templatelab

Closing Costs And Gift Limits Arizona Mortgage House Team

Fha Gift Letter Template Elegant Gift Letter For Mortgage Letter Gifts Letter Templates Letter Example